is a contribution to a political campaign tax deductible

So for example if you donate to a political party candidate or even a. Walker took the tax break in 2021 and 2022 for his Texas home even after launching a bid for Senate in Georgia an official in the Tarrant County tax assessor office told CNNs KFile.

Can You Deduct Political Campaign Contributions From Taxes Money

Money that you may.

. When election season rolls around it can seem like news and. The answer is no. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

Among those not liable for tax deductions are political campaign donations. Any payment contributions or donations to political groups or campaigns are not tax-deductible. Political contributions arent tax deductible.

Political Donations Are NOT Tax Deductible. According to the Internal Service Review IRS The IRS Publication 529 states. Can a deduction to a political campaign be deducted on the donors federal income tax return.

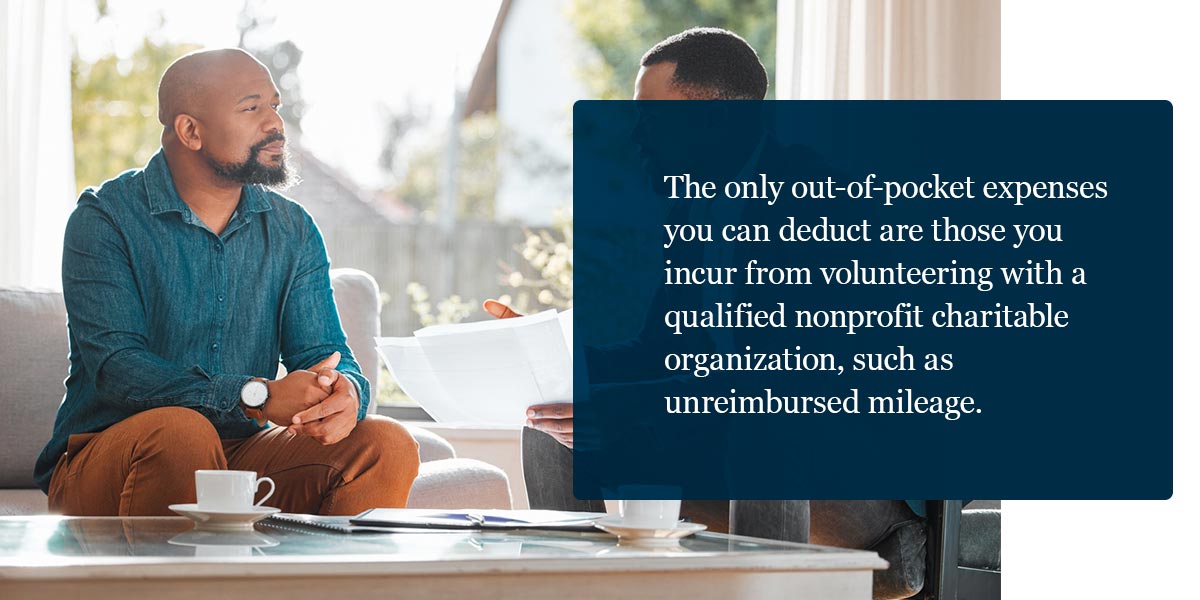

Money that you contribute to a person campaign or political party is not tax deductible. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified. In most states you cant deduct political contributions but four states do allow a tax break for.

January 14 2019. Political contributions deductible status is a myth. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations.

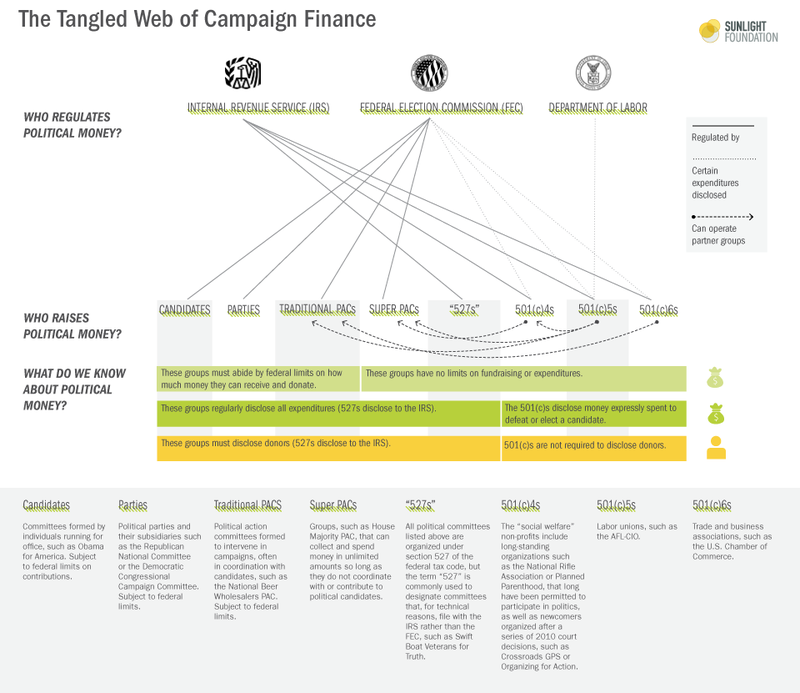

Individuals may donate up to 2900. There are five types of deductions for. This article was originally published on January 31 2018.

Are Political Contributions Tax Deductible Hr Block. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political. A tax deduction allows a person to reduce their income as a result of certain expenses.

Limits on Political Contributions. Generally a taxpayer is allowed a deduction for any. In other words you have an opportunity to donate to your.

IRS allows bonus tax deduction for charitable contributions this year. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. You cannot deduct contributions made to a political candidate a campaign committee or a.

If you made a contribution to a candidate or to a political party. Unlike charitable donations which are tax deductible donations to a political party or PAC are NOT tax deductible. The IRS states You cannot deduct contributions.

Advertisements in convention bulletins and admissions to. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. The IRS has clarified tax-deductible assets.

Manteca City Council May Limit Campaign Donations Manteca Bulletin

How Much Should You Donate To Charity District Capital

Limits And Tax Treatment Of Political Contributions Spencer Law Firm

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Tax Report Is Your Political Donation Deductible Wsj

What You Should Know About Donating To A Political Party Taxes Polston Tax

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Campaign Finance In The United States Wikipedia

Should You Use A Credit Card To Make A Political Campaign Contribution Fox Business

Are Political Contributions Tax Deductible H R Block

Get Involved Flynn For Selectman

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Fec Understanding Ways To Support Federal Candidates

Tax Report Is Your Political Donation Deductible Wsj

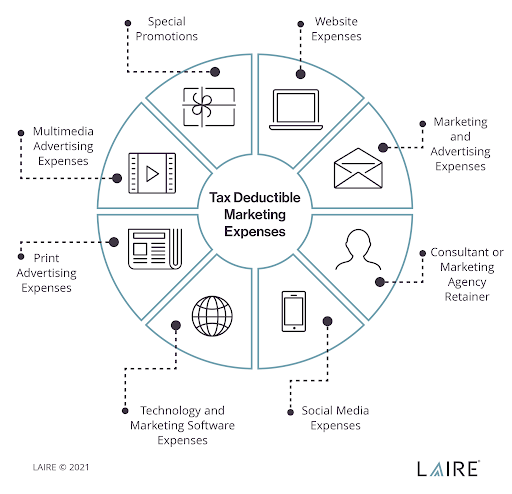

Write Off Your Marketing Expenses And Save Money On Your Taxes

The Secret To Writing Political Donation Letters With Samples